The annual proxy season is more than just a routine exercise in corporate governance; it’s an opportunity for shareholders to voice their concerns, advocate for change, and influence the direction of the companies in which they invest. As the 2023 proxy season unfolds, it’s time to take a closer look at what shareholders are saying and the emerging trends in corporate governance. In this article, we’ll explore the key issues and sentiments expressed by shareholders, the impact of proxy voting, and the broader implications for corporate accountability and sustainability.

Proxy Season Overview

The proxy season, which typically runs from spring to early summer, is the time when publicly traded companies hold their annual shareholder meetings. During these meetings, shareholders vote on a range of corporate matters, including board of directors’ elections, executive compensation, and various proposals that may be put forth by both management and shareholders. It’s a crucial time for investors to assert their influence and make their voices heard.

Shareholder Concerns and Priorities

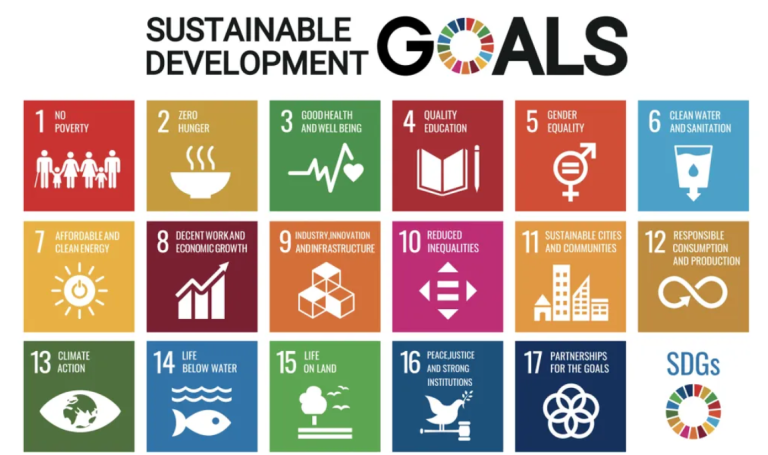

Environmental, Social, and Governance (ESG) Matters

Shareholders continue to emphasize ESG issues. Climate change, diversity and inclusion, and corporate responsibility are top priorities. Investors are increasingly interested in how companies are addressing their environmental impact, fostering diversity at all levels, and demonstrating good governance practices.

Executive Compensation

The issue of executive pay remains a contentious one. Shareholders often scrutinize the fairness of CEO compensation packages, especially in relation to company performance and employee wages. Say-on-pay votes are a common feature of proxy season, allowing shareholders to voice their opinions on executive compensation.

Board Diversity and Independence

Shareholders are advocating for greater board diversity, including gender and racial diversity. They also emphasize the importance of independent directors who can provide objective oversight and protect shareholders’ interests.

Human Rights and Labor Practices

Labor-related issues, including fair wages and working conditions, are gaining prominence. Shareholders are pushing for companies to uphold human rights standards throughout their supply chains.

Sustainability and Reporting

Investors are demanding greater transparency and accountability regarding a company’s sustainability efforts. They want comprehensive reporting on ESG metrics, including progress toward sustainability goals.

Impact of Proxy Voting

Proxy voting is a powerful tool that allows shareholders to exert influence on corporate decisions and advocate for change. Shareholders vote on a range of issues, and their decisions can have a significant impact on corporate policies and practices. Here are some ways proxy voting influences corporate governance:

Board Elections: Shareholders can vote for or against board director nominees. If a director receives a significant number of “against” votes, it can lead to their removal.

Say-on-Pay Votes: Shareholders have the opportunity to express their approval or disapproval of executive compensation packages. A high level of “against” votes may trigger a review of compensation practices.

Shareholder Proposals: Both management and shareholders can propose resolutions on various issues. If a shareholder proposal receives significant support, it can lead to changes in company policies or practices.

Environmental and Social Resolutions: Shareholders can vote on proposals related to sustainability, diversity, climate change, and other ESG issues. Support for these proposals sends a strong signal to companies to take these matters seriously.

Accountability: The results of proxy voting can affect a company’s reputation and investor perception. Failing to address shareholder concerns can lead to reputational damage and a loss of investor confidence.

Broader Implications for Corporate Accountability and Sustainability

The outcomes of the proxy season have far-reaching implications for corporate accountability and sustainability. As shareholders increasingly advocate for ESG principles, diversity, and responsible governance, companies are under pressure to align their practices with these values. Here are some of the broader implications:

Positive Change: Shareholder activism during the proxy season can drive positive changes in corporate behavior. Companies that respond to shareholder concerns on ESG and other matters often perform better over the long term.

Long-Term Sustainability: Embracing ESG principles and addressing shareholder concerns can contribute to a company’s long-term sustainability. It can attract ethically conscious investors and foster a positive corporate image.

Regulatory Impact: The results of proxy voting can influence regulatory decisions. When shareholders demand greater transparency and accountability, it can lead to new regulations and reporting requirements.

Market Reputation: Companies that prioritize ESG and respond to shareholder concerns tend to have a better market reputation, which can attract a more diverse and engaged shareholder base.

The 2023 proxy season is an opportunity for shareholders to shape the future of corporate governance and promote values of sustainability, diversity, and responsible business practices. As shareholder concerns continue to evolve, companies are increasingly recognizing the importance of aligning their strategies with ESG principles. The impact of proxy voting reaches far beyond the annual meetings, influencing how companies conduct their affairs and setting the stage for a more accountable and sustainable corporate landscape. Shareholders are speaking, and their voices are being heard.