Sustainable Exchange-Traded Funds (ETFs) have been making waves in the investment world, driven by the desire to align financial success with environmental and social responsibility. One particular sustainable ETF, with a distinctive pitch, suggests that profits should be given back to benefit society and the planet. In this article, we will explore the novel approach of giving back profits in sustainable investing, examine the unique features of this ETF, and discuss the broader implications of such a strategy.

The Unique Proposition

Traditional investment models typically focus on generating maximum returns for shareholders. In contrast, this sustainable ETF challenges the status quo by proposing a different way of utilizing profits. The core concept behind this unique proposition is to allocate a significant portion of the returns generated by the ETF to support environmental and social initiatives.

Key Features of the Sustainable ETF

Profit Redistribution: The primary feature of this sustainable ETF is profit redistribution. A significant portion of the returns earned by the fund is directed toward various causes, such as renewable energy projects, conservation efforts, community development, and social justice initiatives. The percentage allocated to these causes is defined in the ETF’s prospectus.

Environmental and Social Impact: The ETF focuses on selecting companies and projects with strong environmental and social impact. Investments are carefully curated based on ESG (Environmental, Social, and Governance) criteria, ensuring that the companies in the fund demonstrate a commitment to sustainability, ethical practices, and responsible governance.

Transparency: Transparency is a fundamental aspect of the ETF’s operation. Investors receive regular reports detailing the specific projects and initiatives supported by the fund’s profits. This level of transparency is essential for maintaining the trust of shareholders.

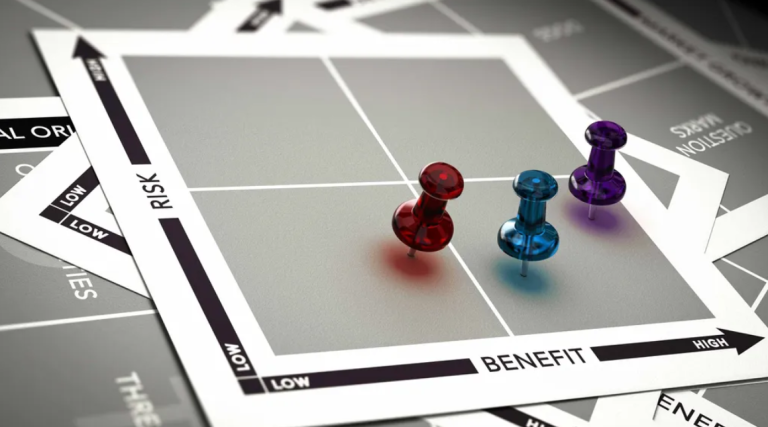

Diverse Portfolio: The ETF maintains a diversified portfolio of investments, spanning different industries and sectors. This diversification helps manage risk and provides opportunities for profits to be generated across various areas of the market.

Collaboration with Impact Partners: The ETF often collaborates with impact organizations and nonprofits to identify and support projects that align with the fund’s mission. These partnerships amplify the fund’s ability to drive positive change.

The Broader Implications

The unique proposition of giving back profits in sustainable investing has several broader implications for the investment landscape:

Redefined Success: This approach challenges the conventional notion of success in investing. Instead of merely measuring success by financial returns, it includes a commitment to environmental and social well-being as a core element of success.

Investor Engagement: It encourages investors to actively participate in the impact they create through their investments. By sharing profits with causes they care about, investors become more engaged in the companies they support.

Influence on Corporate Behavior: Companies that wish to be part of sustainable ETFs with profit-sharing initiatives may be motivated to enhance their ESG practices to attract such investors.

Alignment with Values: This approach resonates with investors who prioritize values and ethics in their financial decisions. It provides them with a way to invest in companies that align with their personal convictions.

Addressing Global Challenges: Giving back profits to environmental and social causes can significantly contribute to addressing critical global challenges, including climate change, inequality, and community development.

Challenges and Considerations

While the unique proposition of giving back profits has its merits, it also presents certain challenges and considerations:

Impact Measurement: Determining the true impact of profit-sharing initiatives can be complex. Investors may need clear metrics and reporting to assess the effectiveness of their contributions.

Risk Management: Balancing the financial performance of the ETF with profit redistribution goals can be challenging. It’s essential to ensure that profit-sharing does not compromise financial sustainability.

Transparency: Transparency is vital for maintaining trust. Investors need regular updates on the allocation of profits to understand the tangible effects of their investments.

Investor Expectations: Clear communication is crucial to managing investor expectations. Investors should have a realistic understanding of the trade-offs between profit-sharing and financial returns.

The unique proposition of sustainable ETFs that give back profits challenges the traditional norms of investing and embraces a broader perspective of success. This innovative approach allows investors to actively contribute to environmental and social causes while generating financial returns. As the investment landscape evolves, this concept reflects a growing desire among investors to align their financial goals with a commitment to environmental and social responsibility. In doing so, this sustainable ETF offers a pathway for investors to be part of positive change and to support the causes they are passionate about.