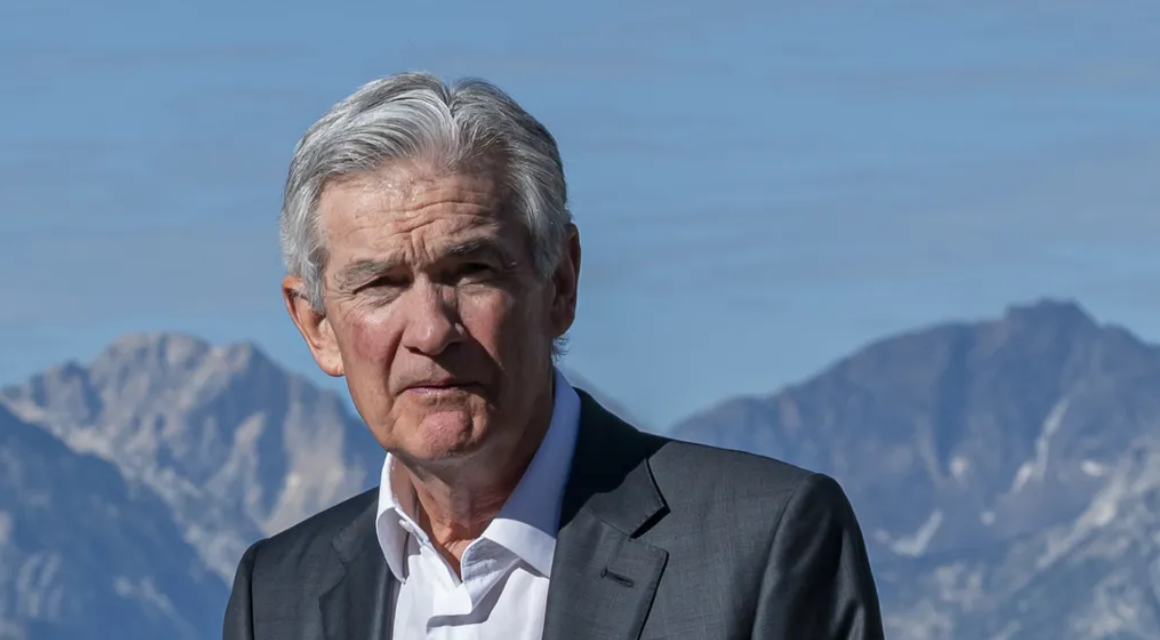

Introduction: Powell’s Pledge for Prudent Policy

In a rapidly changing economic landscape, Federal Reserve Chair Jerome Powell reaffirmed the central bank’s commitment to a cautious and flexible approach. With the global economy facing a myriad of challenges, Powell’s recent statements highlight the Fed’s readiness to increase interest rates further when necessary.

- Monitoring Economic Developments

Powell emphasized the importance of vigilant monitoring of economic data. The Fed’s decisions, he noted, will be data-driven, with a close eye on indicators such as employment figures, inflation trends, and overall economic performance. The Fed’s primary goal is to maintain financial stability and sustainable growth.

- Inflationary Concerns

One of the primary reasons behind the Fed’s willingness to raise rates further is inflation. While price increases have surged in recent months, Powell believes they are primarily driven by temporary factors, such as supply chain disruptions. Nevertheless, the Fed remains ready to act if inflationary pressures prove to be more persistent.

- Balancing Act

The central bank faces a delicate balancing act. On one hand, the Fed must ensure that monetary policy remains accommodative enough to support economic recovery and job creation. On the other hand, it must guard against potential overheating that could lead to uncontrolled inflation.

- Responding to Labor Market Dynamics

Powell acknowledges the complexities of the labor market. While the headline unemployment rate has declined, there are millions of workers still on the sidelines. The Fed aims to support a complete employment recovery. Should the job market demonstrate signs of sustainable strength, this would be a significant factor in determining future interest rate adjustments.

- Communication and Transparency

The Federal Reserve has placed a strong emphasis on clear communication and transparency. This approach aims to reduce uncertainty in financial markets and provide businesses and consumers with a stable outlook. Powell’s consistent messages are part of this broader strategy to minimize surprises.

- Global Economic Interdependence

The interconnected nature of the global economy plays a substantial role in the Fed’s decision-making. The economic policies of other nations, geopolitical events, and trade relationships all impact the Fed’s considerations. Powell’s recent statements recognize the importance of these external factors.

- Preparing for Policy Changes

The Federal Reserve has started to reduce its monthly asset purchases, a significant step in preparing for future policy adjustments. Powell reassured that these measures will be taken in a gradual and orderly manner to minimize market disruptions.

- Rising Interest Rates

While the Fed remains prepared to raise rates, the central bank has been deliberate in its approach. Any future rate hikes will be a response to observed economic conditions, and the timing and pace of these hikes will be tailored to the specific circumstances.

Conclusion: Fed’s Commitment to an Adaptable Path

Powell’s recent statements underscore the Federal Reserve’s commitment to adapt to the changing economic landscape. While the central bank stands ready to raise rates further if required, it remains focused on data-driven decision-making and clear communication. These elements are part of the Fed’s broader strategy to maintain economic stability while navigating the complexities of today’s global financial environment.