ESG (Environmental, Social, and Governance) investing, which integrates environmental, social, and ethical factors into investment decisions, has witnessed a surge in popularity over the past decade. This approach allows investors to align their portfolios with values like sustainability, social responsibility, and ethical governance. However, ESG investing is facing a growing backlash, with critics questioning its efficacy and impact on returns. In this article, we’ll explore the ESG investing backlash, its key arguments, and the ongoing debate about striking the right balance between sustainability and financial returns.

The Rise of ESG Investing

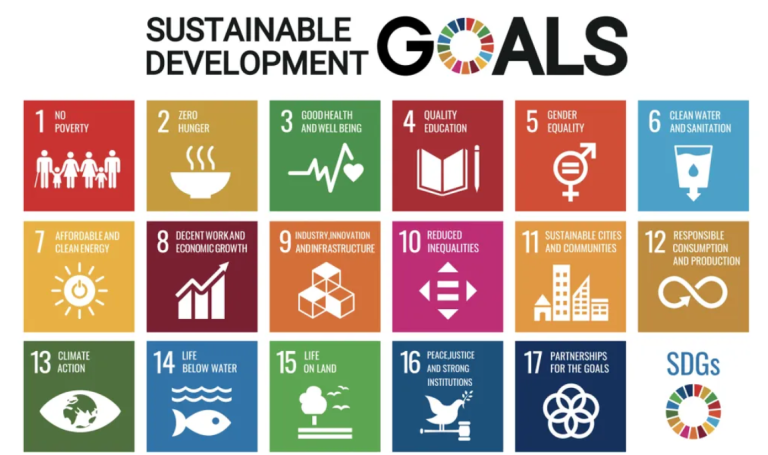

ESG investing has gained momentum as the world confronts pressing issues like climate change, social inequality, and corporate governance scandals. Investors increasingly seek to make a positive impact through their investment choices. ESG criteria have evolved into a framework for evaluating companies and investment opportunities. It includes factors such as:

Environmental: Assessing a company’s impact on the environment, which includes factors like carbon emissions, resource usage, and sustainable practices.

Social: Evaluating a company’s relationships with employees, communities, customers, and broader society. This encompasses issues such as labor practices, diversity, and community engagement.

Governance: Scrutinizing the governance practices of a company, including board composition, executive compensation, and adherence to ethical principles.

The ESG Investing Backlash

While ESG investing has garnered substantial attention, it has also faced a growing backlash, primarily driven by the following arguments:

Performance Skepticism: Critics contend that ESG investments may underperform traditional investments, as the focus on non-financial criteria could lead to suboptimal financial outcomes. They argue that ESG constraints may limit the investment universe and hinder returns.

Data and Standardization Challenges: Some skeptics highlight the lack of standardized ESG data and metrics, which can make it difficult for investors to compare and assess companies consistently.

Greenwashing: Greenwashing refers to the practice of companies exaggerating their commitment to ESG principles for marketing or public relations purposes. Critics argue that this misleading information can lead investors to make decisions based on inaccurate claims.

Dilution of Impact: Critics question whether ESG investing genuinely promotes positive change in the world or if it merely dilutes the social and environmental impact of responsible investments by including companies that make limited contributions to sustainability.

Financial Materiality: Some argue that not all ESG factors are financially material, meaning that they may not significantly impact a company’s financial performance. Critics contend that investors should focus on the factors most likely to affect returns.

Balancing ESG with Returns

The backlash against ESG investing has prompted a debate about finding the right balance between sustainability and financial returns. Here are key considerations in striking that balance:

Performance Data: ESG proponents argue that performance data shows that ESG investments can be competitive with, or even outperform, traditional investments. It’s essential for investors to assess performance records and evaluate ESG funds’ past performance.

Materiality Assessment: Assessing the materiality of ESG factors is crucial. Investors can prioritize the most financially relevant ESG criteria while recognizing that some non-material factors may still be important from an ethical perspective.

Standardization and Transparency: ESG investing can benefit from increased standardization and transparency in reporting. This will enable investors to make informed decisions based on consistent data.

Avoiding Greenwashing: To avoid greenwashing, investors should conduct thorough due diligence, ensuring that companies’ ESG claims are backed by tangible actions and impacts.

Diversification: A diversified portfolio can help mitigate some of the risks associated with ESG investing. By spreading investments across various assets, regions, and sectors, investors can reduce the impact of any single underperforming investment.

Long-Term Perspective: ESG investing often aligns with a long-term perspective. Investors with a commitment to sustainability should recognize that the impact of ESG initiatives may become more pronounced over time.

The ESG investing backlash highlights the need for a balanced approach that considers both sustainability and financial returns. While critics raise valid concerns about ESG investing, proponents argue that it can be competitive with traditional investments and contribute to a more sustainable and responsible financial landscape. Striking the right balance between ESG and financial returns requires careful consideration of performance data, the materiality of ESG factors, standardization and transparency, and a commitment to avoiding greenwashing. As ESG investing continues to evolve, the debate surrounding its efficacy and impact will persist, driving improvements and increased awareness in the financial industry.